🤑 The Cost of Living

- Kishore Karthikeyan

- Feb 18, 2024

- 4 min read

Is your money REALLY worth what you think? Let's unravel the harsh truth about the Purchasing Power Parity.

🤯 Guide to PPP

Well, let's start from the basics - What is Purchasing Power Parity?

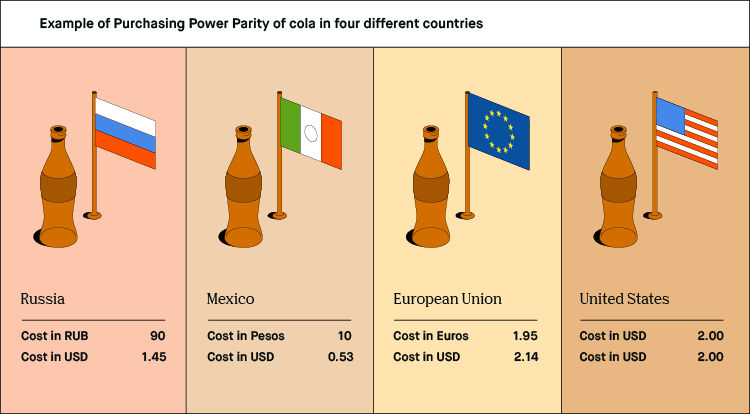

So Wikipedia defines PPP as "A measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currencies."

In simple terms, the price of a tomato in Austin, USA is entirely different from Bengaluru's tomato price. Why? Well, it is the result of a lot of economic factors such as the Demand-Supply curve, Global Trade, currency exchange rate fluctuations, etc. But I am not gonna deep dive into all of these and make this a boring one.

But what I wanted to stress is the cost of living and not arrive at a conclusion but to throw some factors to make an informed decision.

💳 How PPP Shapes Your Wallet?

Let's say you have 2 job opportunities - Job A & Job B.

Job A is in the US paying 2k USD and Job B is in India paying 100k INR. Of course, both are in different currencies and we will convert both to INR to make a fair comparison.

Job A is paying 200k INR and B is 100k INR (considering avg. exchange rate of 1 USD = 100 INR). Obviously, people will opt for Job A in the US cause it pays more relatively here. But actually, what people are missing in this calculation is the purchasing power parity, which is one of the major factors to be considered while making this decision.

Many individuals argue that it is difficult to calculate the PPP rate, but I have a simpler way of calculating the PPP which I call the 4-3-2 method.

💰 The 4-3-2 Method

While you are calculating the salary in the US, after converting to INR divide the US salary by factor 4. So in this case, 200k INR/4 = 50k INR which is half of the salary of Job B (100k INR).

Why divide it by factor 4?

As I said before it is because of the PPP and since the prices of different commodities are different in the US compared to India. And this factor changes for different countries. For UK = 3, UAE = 2. That's why it is called the 4-3-2 method.

85 lakhs INR in the USA = 22 lakhs INR in India

85 lakhs INR in the UK = 28 lakhs INR in India

85 lakhs INR in the UAE = 42 lakhs INR in India

Obviously, I made a lot of assumptions here, and one of the major assumptions that I made here is that I considered only the Post-Tax salaries and the tax rates vary from country to country. So while using this 4-3-2 method, always prefer calculating with the post-tax salary of both countries.

One major point here is that this 4-3-2 method is only applicable when you are comparing India Vs other nations. When you want to compare the EU Vs the USA, the dividing factor can be different.

The different POVs

I have pretty much given a financial perspective. Now that we know the cost of living in different countries and how much we should earn to meet the demands, let me give a few points of view while deciding where to settle down for a job.

Quality of Life - I am mentioning this primarily cause, India has the worst air and food quality compared to other nations. Of course, the US food system is also majorly fucked up with QSRs but European food standards are still valued highly in the global markets.

Proximity to family and friends - The value that you can bring by staying close to your family and friends is something that can't be quantified but still has a major impact while making a job decision.

Tax Rates - As I mentioned before, the tax rates are different in different countries and some Middle East nations have zero-tax policies and that's the reason you find filthy rich people in Dubai, Monaco, etc.

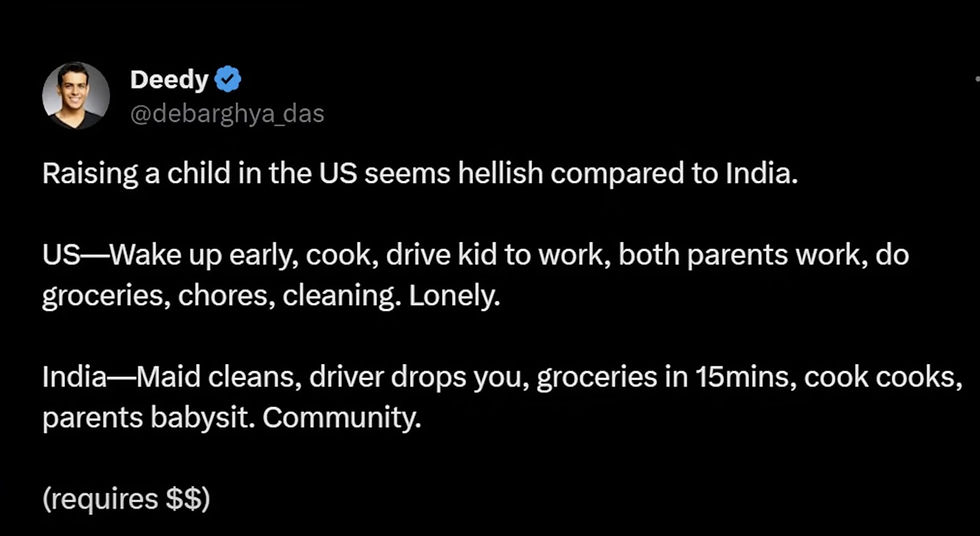

Cultural Indifference - With the woke culture growing rapidly in the US, personally I know a lot of Indians who want to or have already moved back to India cause they wanted to have their kid's education in India.

Other factors such as -

Inflation %

Healthcare System which is poor in India but super expensive in the US. EU has a decent healthcare system with Social Security taking care of 95% of your expenses.

The Tipping Culture is crazy in the US with 20% and 0% in the EU and optional in India.

Language Dependency - the EU has its native languages for each of its countries while in the US or India, it is extremely convenient with English.

Surplus labour force - found this tweet so relatable.

So work out the pros and cons and figure out which country is suited for your lifestyle of living while using the 4-3-2 method to make a financial decision.

Comment down your notion and which country you feel makes more sense.

Comments